Almost every city within Maricopa county charges a city rental tax that typically ranges between 1-3% (referred to as TPT). Many Phoenix investment property owners are under the incorrect impression that if they only own one Phoenix rental property that they are not required to pay the city monthly tax. However rental tax is due on EVERY rental property and is the requirement of the property owner to pay on a monthly, quarterly or annual basis depending on their filing schedule.

Over the past few years there have been several changes in the process that has certainly caused a lot of confusion. Originally the Arizona Department of Revenue (AZDOR) was responsible for collecting the rental taxes for some of the cities such as Surprise, Litchfield Park & Buckeye and they then they forwarded on the money to the appropriate city. At the same time, other cities such as Avondale, Peoria, AZ & Glendale, AZ were collecting their own taxes.

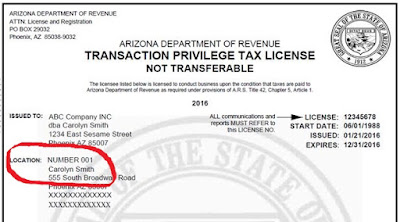

Two to three years ago the AZDOR began the process of what they call "simplifying" the TPT tax process. As a result they started requiring each property owner to obtain an individual transaction privilege license through their office and originally required the tax from each property to be paid individually thereby making it impossible for property managers to file taxes on behalf of their property owners. They then repealed that decision realizing that they couldn't handle the volume of property owners then needing their own individual license so property management companies could file again for their clients.

Beginning this year more changes came about as part of the "simplification" process! Now, the AZDOR processes and collects the city rental taxes for all cities within Maricopa County who charge such a tax. As a result, if you self manage your Phoenix rental property you MUST obtain an individual TPT license from the AZDOR and file the monthly taxes with them directly. So far example, if your property is located in Peoria, AZ you no longer pay the city of Peoria quarterly you must pay monthly to the AZDOR.

Additional changes have also come about with the purchasing of the city business license/transaction privilege license. For those cities in which a business license was required such as Peoria, AZ and Surprise, AZ you now have to pay for both the AZDOR and the city license so for example with a rental property in Peoria, AZ your license cost last year was $50.00 paid to the City of Peoria versus $62.00 for this year paid to the AZDOR ($12.00 for the AZDOR license and $50.00 for the City of Peoria).

As with most city & federal "programs" you don't actually receive anything for the tax and license fees that you pay they are just required and basically just become city revenue. However, be sure you are up to date and in compliance because if not and you fail to file you will be subject to late fees and penalties. For additional information you can visit www.azdor.gov TPT section

RPMWV Phx offers full service Phoenix Real Estate & Phoenix Property Management services. For additional information you can contact us at info@rpmwvphx.com or 623-748-7800.

No comments:

Post a Comment